Understanding Forex Trading A Comprehensive Guide 1622729110

What is Trading Forex?

Forex trading, short for foreign exchange trading, is the act of buying and selling currencies in the foreign exchange market. This market is the largest and most liquid financial market in the world, where daily transactions exceed $6 trillion. Forex traders buy and sell currency pairs, speculating on their movements to profit. For those interested in delving deeper into Forex, resources like what is trading forex fx-trading-uz.com can offer valuable insights.

The Basics of Forex Trading

At its core, Forex trading involves the exchange of one currency for another. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or USD/JPY (US Dollar/Japanese Yen). Each currency pair has a base currency (the first one) and a quote currency (the second one). The price of a currency pair reflects how much of the quote currency is needed to purchase one unit of the base currency.

How Forex Trading Works

The Forex market operates on a decentralized global platform where financial institutions, corporations, and individual traders participate. Trading occurs over-the-counter (OTC) via electronic networks, rather than on a centralized exchange. The Forex market is open 24 hours a day, five days a week, allowing traders to participate at any time from anywhere in the world.

Key Participants in the Forex Market

The Forex market consists of various participants, including:

- Central Banks: They manage a country’s currency value and control monetary policy.

- Financial Institutions: Banks and hedge funds that engage in large-scale Forex transactions.

- Corporations: They may need to exchange currencies for international trade and investment.

- Retail Traders: Individuals who trade currencies for personal profit.

Currency Pairs and Their Types

Currency pairs are categorized into three main types:

- Major Pairs: Consist of the most traded currencies, such as EUR/USD and USD/JPY.

- Minor Pairs: These are less commonly traded pairs, like GBP/CHF or AUD/NZD.

- Exotic Pairs: Involves a major currency paired with a currency from a developing economy, such as USD/TRY (US Dollar/Turkish Lira).

Forex Trading Strategies

Successful Forex trading involves using various strategies to analyze market movements and make informed decisions. Some popular trading strategies include:

- Day Trading: Buying and selling currencies within the same trading day to capitalize on short-term price movements.

- Swing Trading: Holding currency positions for several days to capture more extended trends.

- Scalping: Making numerous trades throughout the day to earn small profits from tiny price changes.

Technical Analysis vs. Fundamental Analysis

Traders typically employ two main types of analysis to inform their trading decisions:

Technical Analysis

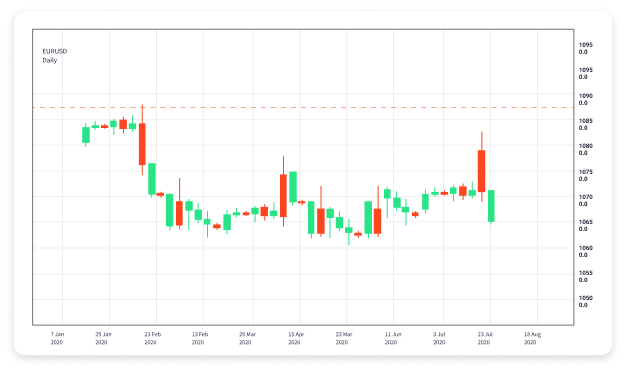

Technical analysis focuses on historical price data and market trends to forecast future price movements. Traders use charts, indicators, and various tools to identify patterns and potential entry and exit points.

Fundamental Analysis

Fundamental analysis, on the other hand, evaluates the underlying economic factors that influence currency values. Factors such as interest rates, economic growth, political stability, and inflation can impact currency strength.

Risks Involved in Forex Trading

While Forex trading can be profitable, it is also accompanied by several risks:

- Market Risk: Currency prices can fluctuate dramatically due to economic or political events.

- Leverage Risk: Many platforms offer high leverage, meaning traders can control large positions with a small initial investment but can also lead to significant losses.

- Liquidity Risk: In volatile markets or with exotic currency pairs, it may be challenging to execute trades at desired prices.

Choosing a Forex Broker

Selecting a reliable Forex broker is crucial for successful trading. Here are key factors to consider:

- Regulation: Ensure the broker is regulated by a reputable authority.

- Trading Platform: Look for a user-friendly platform with essential tools.

- Spreads and Fees: Compare the costs associated with trading, including spreads, commissions, and other fees.

- Customer Support: A responsive support team can be valuable, especially for new traders.

Conclusion

Forex trading offers exciting opportunities for individuals looking to profit from currency fluctuations. By understanding the market’s workings, employing effective trading strategies, and carefully managing risks, traders can navigate this dynamic landscape. Whether you’re a beginner or an experienced trader, continuous learning and adapting to market changes will enhance your trading journey in the Forex world.