Continuation Patterns: Trading Strategies For Success

Continuation standards: commercial strategy for cryptocurrency success

In recent years, the world of cryptocurrency negotiations has observed an increase in popularity and thousands of new users enter the market every day. While some made significant profits, many others have lost money due to bad strategy and lack of education. An effective strategy, which has become effective, is the standards of continuation that can help traders make conscious decisions and avoid possible losses.

What are continuation patterns?

Continuous standards are related to the type of technical analysis, which includes the identification of specific price movements or a change in rotation volume in a specific cryptocurrency exchange. These standards can be used to predict future pricing stocks and provide valuable information to traders who want to make profitable transactions.

Why use continuation patterns?

The use of continuation projects offers several advantages, including:

* Improved accuracy : When analyzing historical data and identifying coherent patterns, traders may increase their chances of making precise predictions about market direction.

* Reduced risk : Continuous patterns help traders avoid rewriting, which is a common source of losses in the cryptocurrency market. By limiting the number of transactions per day, traders can reduce their exposure to market fluctuations.

* Increased confidence : By identifying credible standards of continuation, traders can gain confidence in their ability to make informed trade decisions.

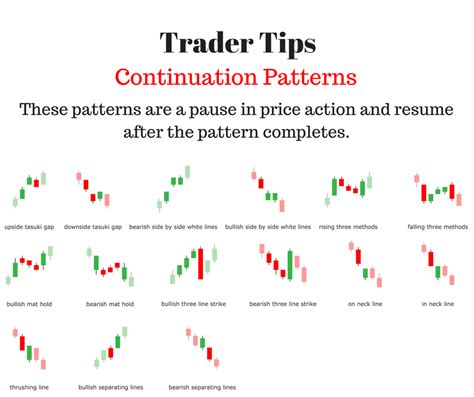

Types of continuation patterns

There are several types of continuation patterns used by traders, including:

* Sailing Patterns : They include candle charts analyzing and identify specific movements or price changes.

* Shooting Indicators : They include an analysis of technical indicators such as RSI, Bollinger bands, and stochastic oscillator to identify areas with high hurry or low race.

* Support and Resistance Horizers : They include identifying specific price levels, which are usually used by traders to define detention or transaction input points.

Commercial strategies using continuation standards

Here are some business strategies using continuation standards:

1.

- Crossover strategy of the drive indicator : This includes the purchase of cryptocurrency, when the moment indicator is exceeded on the filming indicator, which indicates a potential reversal trend.

3.

Best practices of using continuation patterns

To maximize the effectiveness of continuation patterns, traders must follow the best practices:

* Use reliable data sources : Make sure the data sources are accurate and reliable.

* Carefully monitor the graphics : Pay special attention to graph patterns and trends.

* Say your portfolio : Spread your transactions in many cryptocurrencies to minimize risk.

* Be patient and disciplined : Continuation patterns can be a long -term game, so it is necessary to remain concentrated and avoid impulsive decisions.

Application

Continuous standards offer a powerful tool for traders who want to make conscious decisions in the cryptocurrency market. By analyzing historical data and identifying specific price movements or changes, traders can gain confidence in their ability to predict future price activities. Although negotiation with continuation standards include risks, compliance with best practices, and maintaining patience and discipline can help maximize its effectiveness.